At the beginning and end of every period, companies must open and close their temporary accounts in order to record their financial information for reporting purposes accurately. This process shifts the balance of funds and effectively brings the closing balance to zero. This means thatit is not an asset, liability, stockholders’ equity, revenue, orexpense account. We see from the adjusted trial balance that our revenue accounts have a credit balance. To make them zero we want to decrease the balance or do the opposite.

Step 4: Close withdrawals account

This gives you the balance to compare to the income statement, and allows you to double check that all income statement accounts are closed and have correct amounts. If you put the revenues and expenses directly into retained earnings, you will not see that check figure. No matter which way you choose to close, the same final balance is in retained 7 ways to improve your accounts receivable collections earnings. To further clarify this concept, balances are closed to assure all revenues and expenses are recorded in the proper period and then start over the following period. The revenue and expense accounts should start at zero each period, because we are measuring how much revenue is earned and expenses incurred during the period.

- The main change from an adjusted trial balance is revenues, expenses, and dividends are all zero and their balances have been rolled into retained earnings.

- With the use of modern accounting software, this process often takes place automatically.

- Temporary accounts differ from permanent accounts, which do not need to be opened and closed each period as they show the ongoing financial position of a business.

- Steps 1 through 4 were covered in Analyzing and Recording Transactions and Steps 5 through 7 were covered in The Adjustment Process.

- If both summarize your income in the same period, then they must be equal.

Drawings Accounts and Closing Journals

The income summary account is an intermediary between revenues and expenses, and the Retained Earnings account. It stores all of the closing information for revenues and expenses, resulting in a “summary” of income or loss for the period. The balance in the Income Summary account equals the net income or loss for the period. This balance is then transferred to the Retained Earnings account. What is the current book value of your electronics, car, and furniture? Are the value of your assets and liabilities now zero because of the start of a new year?

How are closing entries posted in the general ledger?

You can report retained earnings either on your balance sheet or income statement. Without transferring funds, your financial statements will be inaccurate. Notice that revenues, expenses, dividends, and income summaryall have zero balances. The post-closing T-accounts will be transferred to thepost-closing trial balance, which is step 9 in the accountingcycle. You might be asking yourself, “is the Income Summary accounteven necessary?

Notice that revenues, expenses, dividends, and income summary all have zero balances. The post-closing T-accounts will be transferred to the post-closing trial balance, which is step 9 in the accounting cycle. Closing entries prepare a company for the next accounting period by clearing any outstanding balances in certain accounts that should not transfer over to the next period. Closing, or clearing the balances, means returning the account to a zero balance.

In which journal are closing entries typically recorded?

You need to create closing journal entries by debiting and crediting the right accounts. Use the chart below to determine which accounts are decreased by debits and which are decreased by credits. Understanding the accounting cycle and preparing trial balancesis a practice valued internationally. The Philippines Center forEntrepreneurship and the government of the Philippines hold regularseminars going over this cycle with small business owners. They arealso transparent with their internal trial balances in several keygovernment offices.

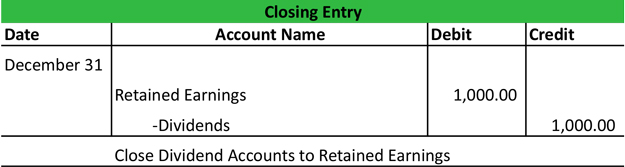

Temporary accounts can either be closed directly to the retained earnings account or to an intermediate account called the income summary account. The income summary account is then closed to the retained earnings account. The retained earnings account is reduced by the amount paid out in dividends through a debit and the dividends expense is credited.

If dividends are declared, to get a zero balance in the Dividends account, the entry will show a credit to Dividends and a debit to Retained Earnings. As you will learn in Corporation Accounting, there are three components to the declaration and payment of dividends. The first part is the date of declaration, which creates the obligation or liability to pay the dividend. The second part is the date of record that determines who receives the dividends, and the third part is the date of payment, which is the date that payments are made. Printing Plus has $100 of dividends with a debit balance on the adjusted trial balance.

All expense accounts are then closed to the income summary account by crediting the expense accounts and debiting income summary. At the end of the year, all the temporary accounts must be closed or reset, so the beginning of the following year will have a clean balance to start with. In other words, revenue, expense, and withdrawal accounts always have a zero balance at the start of the year because they are always closed at the end of the previous year. Temporary account balances can be shifted directly to the retained earnings account or an intermediate account known as the income summary account. You must debit your revenue accounts to decrease it, which means you must also credit your income summary account. Without closing revenue accounts, you wouldn’t be able to compare how much your business earns each period because the amount would build up.

بدون دیدگاه